Parameters

Borrow Rate Model

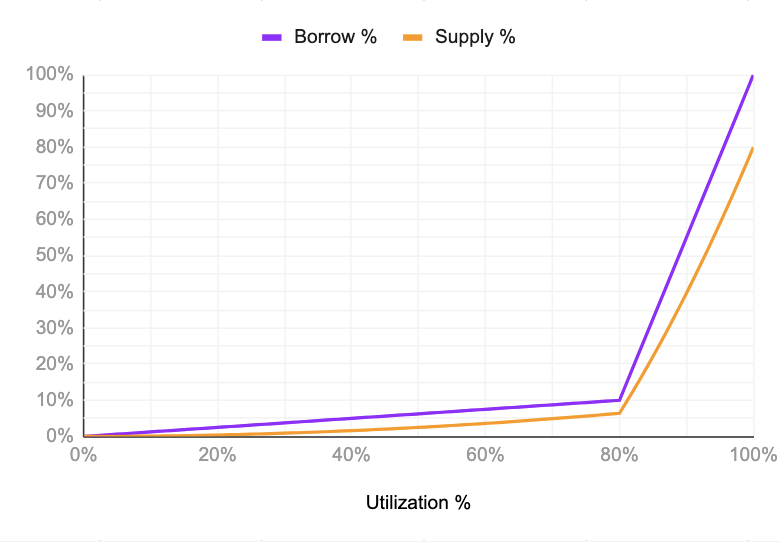

Interest rates are dynamic and are calculated based on the utilization of a given market (how much of the supplied liquidity is available vs. borrowed). Poseidon Lend's interest model follows Compound Protocol's Jump Rate model.

The borrow rate model that Poseidon Finance adopts is as follows. When the utilization rate increases, both borrowing rate and supply rate will rise. When utilization rate is over the kink point, the borrow rate will soar at a higher rate.

FRA

FAIRY

BTC

ETH

BNB

USDT

USDC

BUSD

Last updated